To the rich, the thing of value is their membership in the elite ownership class. Like their pedigree, station, title and position means they can call the shots. He talks about how they go to the right school, know the right people and get paid in company equity.

- 帖子

- 3

- 评论

- 35

- 加入于

- 6 mo. ago

- 帖子

- 3

- 评论

- 35

- 加入于

- 6 mo. ago

Sort of? Due to my age, the year I would hit traditional retirement age is later than many of the predicted crises becoming emergent (combined crop failures, climate change, financial collapse, peak oil, etc.). So basically my personal discount rate looks radically different from most people I know around my age because most people are either not collapse aware or they deny the implications of collapse as a self defense mechanism.

So I see myself as having semi-retired or active retired extremely prematurely. I did a bunch of travel and moved around and found a new life when it was still kind of cheap and easy before covid. I traveled 50,000 miles in an old van over 5 years for the total budget of 2 months income on the job I walked away from. The highest cost was the opportunity cost, like not working and earning during those 5 years. Travel was cheaper than living in one place when I had a job.

When covid hit I was living in an ecovillage bordering 2 million acres of forest and mountains and the world didn't change really at all, except seeing more cool predators on hikes. I was already ahead of the curve.

I have a collapse job (think professional scavenger) and its extremely countercyclical with the health of the overall economy. I live well below my means and save money on very few hours of compulsory work. I actually volunteer in my community as much as I work for money. I basically pulled out of the rat race around 2010 and have been building a life I really like since then. How do you eat an elephant? A bite at a time. I am prepared do continue this way until it's not possible, I don't care about age at all.

This is covered in the article but being available to work he says costs a family about $50,000 (clothes, commuting etc) a year. I now work from home in my pajamas and fill a lot of my needs directly instead of buying in the market. So stuff like gardening, yard work, car repairs, home repairs etc I do for myself because I have the time. I have developed a weird array of skills that would get me through the Apocalypse. I can garden, fix drywall, repair a chainsaw or do your non-profit's taxes. It didn't start out like this.

Getting out of the rat race was hard. Its not difficult to stop but its hard to let go completely. Like letting ambition and success fall away and rebuilding an identity based on self reliance was harder than my previous career ladder.

[ * ] most of my peers seem to be running on a treadmill. Like piling up money in a high cost of living area they seem to never really get anywhere, and >poof< that's their real life! Like they are chasing a mirage with their real one only life. My one friend is going to be the best 85 year old scuba diver one day when he retires! He will have so much money then.

When you get the call, hang up the phone.

The system wants everyone Numb or Dumb.

For extremely successful people, they are busy out of their minds and distracted with sports, shopping, zoned out on comfort and affluence living in a privileges bubble.

For everyone else, the situation is just this futility of never being able to make it. The system is geared to keep everyone stuck and subservient and employable and dependent. Caught in a system of traps that seem designed for maximum inertia.

People either don't Want anything to change or feel Powerless to make it change. I don't meet many people who are working to replace the system.

The 2008 global financial crisis had all these deep causes, but the timing came in an interesting moment in history. 2008 was right around the exact moment that the first / oldest among the baby boomer generation were reaching the retirement age.

That generation was really the first cohort to really go all-in on personal investing and financial assets for funding a retirement.

Anyhow, as a result, many many of these people had their nest eggs wiped out, losing as much as half their life savings. The media carried all these stories about how people would think they were investing in a car company (say GM) and then lose money in a supposed housing market melt down (through GMAC mortgages). In the murky web of global finance everyone was exposed to toxic assets.

I do not believe the boomers retiring caused the crisis, but rather it worked the other way around, that the bigger the pile of loot became the more tempting it was to raid the money.

But, yeah...just to echo your personal stance, I got to watch all my family and relatives fail to retire. The whole thing was a stark lesson. I sold all financial investments in 2010 which was basically (adjusted for inflation) the first reasonable rebound of the market. I'm very happy I did so and have never reverted.

Don't mistake money for wealth!

The farther I stand back and squint, it looks like a giant casino. Everyone is all into "momentum investing" where it's all about hopping onto hot stocks and hopping back off at a higher price, basically it has nothing to do with actual companies with actual business ideas making actual products that improve lives. Its just people making a quick buck for playing with extra money. Nothing could ever go wrong.

All the mom-and-pop local ski areas gave out to the big corporate chains. The analogy holds that far.

Even more ironically, the big ski chains had access to cheap capital (they were trading on the stock exchange) and they converted their money into building re-sellable ski slope-side condos and vacation homes. Basically every ski area had undeveloped real estate which they built out.

If you looked at the security filings, the ski area business was running at break-even. After all the staff costs, snowmaking, operating costs etc the revenue they take in for the whole entire countru generated no profit whatsoever.

They basically "made money" on selling condos, and they literally built every condo they possibly had the potential to ever build and ran out of inventory. That was a one time cash-out move that cannot be repeated. If the ski areas start to fail it'll be a huge rug-pull on all these small time investors. There are already towns where the ski area closed and hotels and resorts just got shuttered and fell into obsolescence.

You can almost see the ruins of the future for farming in this story. Every farmhouse , rural community etc is on the chopping block once this shifts into high gear. Like every farm community is a bunch of small time investors who are holding the bag in the end. They all have mortgages, loans on equipment and have poured everything into physical assets that have little or no value in a different future that's coming at us fast.

Every one of these farmers can turn and look back generations and see proof farming is possible, and then you turn and face the future and its a different outlook. Every bad growing season is another shockwave.

There was a post on the other site (~ 6 months back) where the headline was that a computer model predicted increasing crop YIELDS all the way out to year 2100. All the techno-utipians were rejoicing and talking about all the whiz bang agri-tech that is beating the doomsayers.

I did a bit of a deep dive and it was pretty interesting in the deep details. Basically all the big measurements are heading in a dismal direction. Like the number of acres, the size of the total crop, the costs, soil fertility, soil depth, aquifer depletion... We basically strip mined a lot of agricultural land and its all depleting in a non-renewable sense.

So farmers have indeed responded, kind of forking in two directions. One direction is to add more inputs (pesticides, irrigation, machinery etc) to bolster production. The other direction is to take lands right out of production...like shifting to dryland, shifting to grazing range or even totally abandoning everything.

So if you're grasping for a "line goes up" narrative, YIELD is convenient to the story.

What YIELD is, is production per area figure. So like, if you jettison all these marginal failing fields, your "average" climbs. Because you're making the denominator smaller FASTER than you're making the numerator smaller. But production is falling!

So an example would be that a state with failing rainfall needs to reduce all tbr cornfields that depend on rain. Maybe 30% of the fields shift to beans or some other crop. So now, you look at only these remaining plots of corn and they are getting jacked from well water, pesticides, fertilizer and such. The Yield number is healthy even though your cost per corn / total production per corn crop number just took a bloodbath.

Its super wild how distorted and perverse the impression was coming out of the release of that study. Its basically propaganda?!

Part 1 (which you are reading) points this out:

And the system is designed to prevent them from escaping [from poverty + precarity]. Every dollar you earn climbing from $40,000 to $100,000 triggers benefit losses that exceed your income gains. You are literally poorer for working harder.

Part 2 is here.

The wealth you’re counting on—the retirement accounts, the home equity, the “nest egg” that’s supposed to make this all worthwhile—is just as fake as the poverty line.

Part 2 points out that all these inflating assets (401k plans, homes, etc) depend for their value on the next generation to ultimately be wealthy enough to want to buy these at a future date at a higher price. The whole "asset inflation" spiral seems like a ponzi scheme of epic proportions since that doesn't appear to be shaping up.

collapse @lemmy.zip The real American household poverty line isn’t $31,200, it’s around $140,000.

That's right, I concede your point, you win the argument, you TOTALLY win, good job.

We will just buy the cooking oil at the supermarkets and convert it to the diesel we need. All the way! Why worry?

For bonus points, you can now guess my race.

It’s getting to the point with climate change where I can’t take the risk of investing in a new crop of wheat or barley because the return on that investment is just so uncertain.

The north american ski areas have a similar problem where snow conditions are highly variable from season to season.

Some big players bought all these independent resorts and amalgamated them into a giant chain with one season pass you can use anywhere. Skiers chase the snow now. This is all a financial hedge against low snow / bad conditions -- the chain makes money somewhere.

They call running a ski area "snow farming".

I just don't know how small farms survive in a financial sense. How many no-profit years can a specific farm endure? You can't move your farm. It costs money to set up the crops every time. All the individual farmers have the same calculus where it's basically an existential risk to even take a swing at growing a crop.

Big corporate chains could diversify across different regions and crop types, but they are basically just bundling the exact same risks that every small farm has now. This can't be good.

Lol. So how do they make the french fry oil?

Currently, biodiesel is less than 1% of all transportation fuels globally, around 1 exajoule. Around half of that comes from the united states in the form of soybean oil -- obviously highly subsidized by fossil fuel inputs, not truly "net energy".

What's your evidence that biodiesel production could scale, say, 3-400X current? Where are you even getting this idea??

If the course toward 3C is unchanged, our civilization risks suffering and death on an unprecedented scale: four billion dead between 2060 and 2090, along with a 50 percent drop in world GDP. The actuaries noted that “no realistic plan [is] in place to avoid this scenario.”

In a very real sense, we could not have gotten into this predicament if we didn't precisely lack the leadership and skills we would need to solve the problems we face now. We are not going to develop a "plan" at this point. Is there a plan for next week?

Sorry actuaries.

The power of our science and technology was put info the hands of people who A) could never have created this world and B) have no idea what to do with our powerful knowledge except to use it to pimp out their own lives.

Nobody is coming to save us. It's like when Dorothy pulls back the curtain and it's just a little green man...

The EROEI limit for our current society is 10:1.

2:1, 3:1 or 4:1 is collapse.

There is a chart here: https://www.issuesofsustainability.org/helpndoc-content/EROIHierarchyofSociety.html

Health care cuts off at 12, education at 9, kids start to work for their survival at 7, food production needs 5, transportation needs 2. This is life as we know it ending.

Below 2, you can extract and produce oil only.

Just for context.

Your first sentence was that 3:1 or 4:1 are "not bad", but I may be missing your meaning.

In the world of yesteryear before industrial fertilizer + diesel, they used animal power in addition to human labor. A horse eats about 10X the food as a person.

The question is about where the sweet spot is. Every person needs food and other resources. Its not a given that a person will produce surplus if the population levels are above the natural carrying capacity of the ecosystem.

At some point excess supply of human labor cannot press peanut oil beyond that person's requirements. Humans are a net drag on the economy if you don't have the resources flows at a fundamentally high enough level. (Like the peanuts are finite.)

So when all else fails manual labor also fails.

Industrialization did not arise in a world made by hand. Industry and machines are a product of the oil age. The problem is that fossil fuel stocks and flows are eventually going to dwindle.

The idea that humans are going to press oil by hand is like the idea powering vehicles from used French Fry deep fryers. Yeah, that's fine as long as you have a running industrial system, but it's not self sustaining. You need PRIMARY energy resources for any of these ideas to turn over.

Very interesting finding on page 10 where they identify 4° global heating as a special limit. Below 4° plants can adapt or migrate. When you go above 4°, it's so different that plants have to evolve into new kinds of plants.

I think one way to read this paper was that in the PETM event, this tipping point was breached and the biosphere was no longer able to sequester carbon (big plant die off) and so the hysteresis of the climate system basically broke. And then it takes 75,000 years or something for new plants to evolve and reset the system.

I think the latest estimates put 2° at 2050 and +0.27 per decade at current rates assuming no new tipping points. Meaning 4°would be coming no later than year 2130.

What the market is pricing as cyclical volatility is actually a phase transition. Industrial civilization is shifting from an era of energy abundance to energy constraint. This is not temporary or reversible through technology or policy—it is thermodynamic reality asserting itself against monetary abstraction.

Pretty great article. Thanks for posting.

Perfect storm coming.

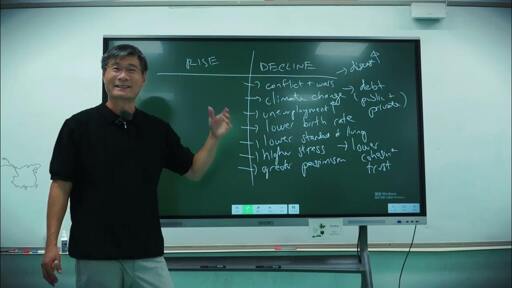

Jump to 50 minutes to hear Professor Jiang's predictions for the coming decades.

collapse @lemmy.zip Video: "How societies collapse" lecture with Professor Jiang

The extinction of plankton is often associated with the Cretaceous-Paleogene (K-Pg) extinction event, which occurred about 66 million years ago and led to significant marine life loss, including many plankton species. This event was caused by an asteroid impact and resulted in the extinction of approximately 75% of Earth's species, including non-avian dinosaurs.

Surely "net zero" will put the brakes on sea level rise?

No, that's not what they report.

Over longer timescales, the committed median sea level rise [...] has been estimated at +0.7 m to +1.2 m, even if net zero greenhouse gas emissions are sustained until 2300, but ~3 m from Antarctica could not be ruled out.

/Furthermore, each 5-year delay in near-term peaking of CO2 emissions increased median SLR at 2300 by around +20 cm, and no net zero scenario gave a median SLR below +1.2 m at 2300 once global mean temperatures exceed +1.5 °C.

Based on the CO2 already in the atmosphere, we are looking at major sea level rise. It takes a while to happen.

What this says is that every 5 years of Business as Usual before we get to net zero, we commit to another 20cm of rise.

Net zero starting today could still be as much as 3m of rise in the pipeline over the next generations.

Due to the hysteresis in the system, if we actually wanted to cancel sea level rise, to refreeze the poles takes an even bigger signal in the opposite direction. So to over power the warming trend we would have to get CO2 down even more below pre-industrial than we raised it.

collapse @lemmy.zip 1.5° is too much global warming for the ice sheets

There is a radical / revolutionary idea around tax reform that frames taxes as being applied to LAND and not improvements.

The argument is that the value of a piece of land derives from the public investments / improvements. Like decent infrastructure, public transportation, good schools etc all raise the market value of a given size of land in a given location.

Then its up to the owner to find a use case / improvement that makes the tax burden "worth it". Like the market incentives are for the highest value of private investment / private use. You don't get rewarded for land banking or sitting on empty lots or making hotels into surface parking, instead you perhaps pay 5% of the value every year AS IF you were doing something that is worthwhile with the property.

Basically the system currently rewards speculation and idle property, and when the public makes an investment in services in an area, the profits get extracted by land owners who essentially privatize the reward by cashing out after doing nothing. A lot of people feel this is fundamentally broken. Not only that, but a lot of these land owners KNOW this is a rigged game and they run city hall and get the public to commit to investments that they stand to profit from.