Chinese Investments in Europe's Energy Sector Create Risk

Chinese Investments in Europe's Energy Sector Create Risk

Chinese Investments in Europe's Energy Sector Creates Risk - 3GIMBALS

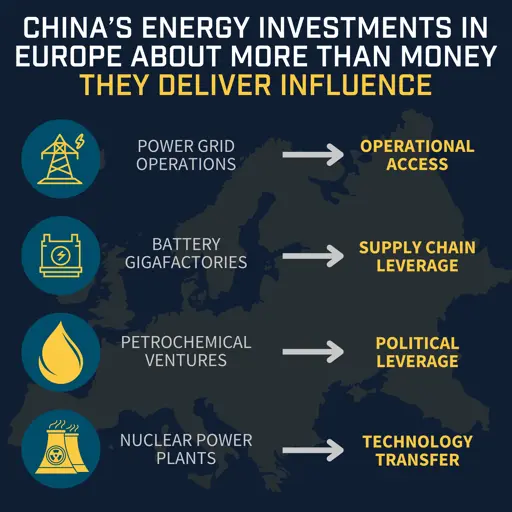

China’s foothold in Europe’s energy sector is no longer viewed through a purely commercial lens. What once seemed like standard foreign investment has evolved into a strategic liability, one that touches the core of Europe’s security architecture. As policymakers take stock, a clearer pattern is emerging: control over the flow of electricity is not just about energy, but about leverage in moments of geopolitical strain [...]

Energy networks, like telecommunications, serve as critical infrastructure not because of what they produce, but because of what they enable. A blackout in the wrong place at the wrong time—whether accidental or engineered—could paralyze civil and military readiness alike. European leaders once worried about reliance on Russian gas; today, they face a parallel concern that power infrastructure could be shaped by actors with competing strategic objectives. The 21st-century battlefield includes cables, substations, and data streams, and in that arena, grid ownership is influence [...]

Europe’s energy sector is no longer an open playing field for Chinese investments. After years of welcoming Chinese capital with few questions asked, policymakers are increasingly treating ownership of critical infrastructure as a national security issue. What began as overdue scrutiny has evolved into a broader recalibration: strategic control is no longer seen as a neutral investment—it’s a risk vector. The shift hasn’t been loud, but it’s gaining traction, one policy tool at a time [...]

Europe’s Energy Awakening is Just the Beginning

The Chinese playbook in Europe’s energy sector mirrors its approach in telecommunications investments: acquire stakes, embed influence, and shape strategic terrain through economic means. These moves have not been purely extractive. At times, Chinese capital has kept utilities afloat and helped launch high-cost infrastructure. But the net effect is a deeper tension between economic interdependence and strategic autonomy.

European governments are now responding with greater caution. The open-door era has given way to a more selective posture, grounded in the recognition that control over energy infrastructure is about more than electrons, it’s about leverage. This evolution, though uneven across the continent, reflects growing convergence with U.S. concerns about China’s use of critical infrastructure as a foreign policy tool.

The European experience offers a warning and a blueprint: when strategic sectors are treated as market commodities, influence follows ownership. The case for screening foreign investments and asserting national control over core systems is no longer theoretical, it’s operational. And as NATO allies and EU members ramp up efforts to secure supply chains and guard against coercive dependencies, China’s tactics will remain a persistent variable.

Beijing, for its part, is unlikely to retreat. Chinese firms are likely to recalibrate, favoring joint ventures, minority stakes, or sectors less likely to trigger scrutiny, but the underlying objective remains unchanged: long-term access, embedded presence, and influence without confrontation.

This emerging pushback is not a blanket rejection of Chinese capital. But it is a statement of limits. Strategic assets are no longer up for silent auction, and Western nations are showing signs of protecting what matters most. Europe’s course correction in its energy sector may prove to be more than reactive; it may be the early test case for how the West manages the expanding Chinese investments across every domain where control and criticality intersect.

[Edit typo.]