Daddy needs money to buy movie studio

- Posts

- 41

- Comments

- 1126

- Joined

- 3 yr. ago

- Posts

- 41

- Comments

- 1126

- Joined

- 3 yr. ago

UK Politics @feddit.uk Don't rule out EU customs union, TUC boss Nowak tells Starmer

UK Politics @feddit.uk Farmers celebrate Sir Keir Starmer's Christmas U-turn on inheritance tax

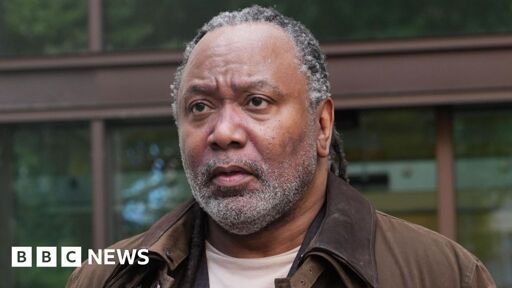

United Kingdom @feddit.uk Reginald D Hunter: Judge quashes antisemitism case brought by Campaign Against Antisemitism

UK Politics @feddit.uk Wes Streeting: Britain needs to join customs union with EU

UK Politics @feddit.uk UK Deficit Falls in First Public Finances Data Since Budget

UK Politics @feddit.uk Wes Streeting condemns Labour donor Dale Vince's Bondi attack remarks - BBC News

United Kingdom @feddit.uk New IRA linked assets frozen by UK government - BBC News

UK Politics @feddit.uk Zarah Sultana takes over company holding £800,000 in Your Party donations after major row

United Kingdom @feddit.uk Lostprophets singer Ian Watkins dies in prison attack

United Kingdom @feddit.uk Palestine Action supporters urged to demand they are taken into custody if they are arrested

United Kingdom @feddit.uk Bands pull out from festival after group 'cut off' over Palestine flag

And Finally... @feddit.uk Wrexham shopkeeper refuses to remove 'scumbag shoplifters' sign - BBC News

UK Politics @feddit.uk Over 200 MPs sign cross-party letter demanding Starmer recognise Palestine as a state

United Kingdom @feddit.uk Warwickshire school apologises to girl over culture day speech refusal - BBC News

Eurovision Song Contest @lemmy.world Eurovision: Spanish PM Pedro Sánchez calls for Israel to be banned - BBC News

Eurovision Song Contest @lemmy.world Eurovision 2025 Results: Voting & Points

Eurovision Song Contest @lemmy.world Israel qualifies for Eurovision final amid protests - BBC News

United Kingdom @feddit.uk Kneecap apologises to families of Sir David Amess and Jo Cox

Buy European @feddit.uk It's time to end the US hegemony on.... oral health. Send me your toothpaste and toothbrush (electric or otherwise) recommendations from Europe.

And Finally... @feddit.uk Cardigan: 'Free spirit' man died after canoe he stole capsized - BBC News

To be fair they asked and answered on pcworld.com