Pro-stealing art without attribution

Chapotraphouse @hexbear.net He has always been goated

Slop. @hexbear.net Aint no way

Slop. @hexbear.net The peasants had a home? no way! I love USSR

memes @hexbear.net Funny meme jpg

technology @hexbear.net The Trump Phone is a Mess

Chapotraphouse @hexbear.net birth rate decline in Japan

Chapotraphouse @hexbear.net Imperialism and Its Bullying of India

Chapotraphouse @hexbear.net The British government’s obsession with the fiscal rules is driving the economy towards recession

art @hexbear.net Lenin

Chapotraphouse @hexbear.net Chapo Reading Series (ft. David Roth) - Free Market Genius Solves New York’s Subway Problems

askchapo @hexbear.net Why is the UK Labour party destroying itself?

Chapotraphouse @hexbear.net British Labour Government should ignore irrelevant fiscal ‘black holes’ and worry about the political hole it is digging for itself

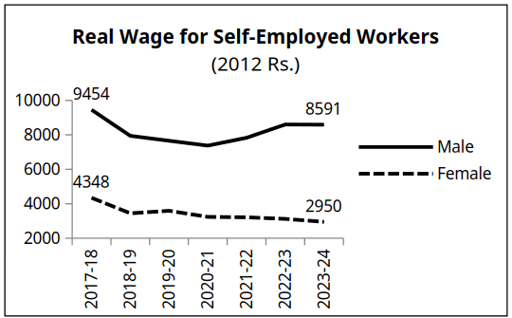

Chapotraphouse @hexbear.net The Depression of Mass Consumption (in India)

History @hexbear.net How Sheikh Mujibur Rahman Ignored Fidel Castro’s Friendly Advice and Paid the Price

Games @hexbear.net How Slow is the Nintendo Switch 2 Display?

Chapotraphouse @hexbear.net Another Nate Plastic L

Chapotraphouse @hexbear.net George W. Trump

Chapotraphouse @hexbear.net The US dollar is losing importance in the global economy – but there is really nothing to see in that fact

Chapotraphouse @hexbear.net South Korean military suspends loudspeaker broadcasts aimed at North Korea

Chapotraphouse @hexbear.net Could You Prove You’re a Citizen?

Interest rates exist. It's set by the central bank.

Please read the book to understand more. This has been a long thread.