Why U.S. Citizens Must Act Now to Protect Their Wealth

In the tumultuous and unpredictable world of global finance, the stability and security once offered by the Bretton Woods system is rapidly deteriorating. Established in the aftermath of World War II, the Bretton Woods Agreement was designed to foster international monetary cooperation and create a framework for economic stability. However, as we face unprecedented economic challenges, the very foundations of this system are crumbling, signaling an imminent collapse. In this precarious environment, it is crucial for U.S. citizens to take immediate action to safeguard their wealth and prepare for the uncertain future. This article explores why converting U.S. dollars into tangible assets such as farmland, food, ammunition, firearms, precious metals, and privacy-focused cryptocurrencies like Monero is not just prudent, but essential.

The Decline of the Bretton Woods System

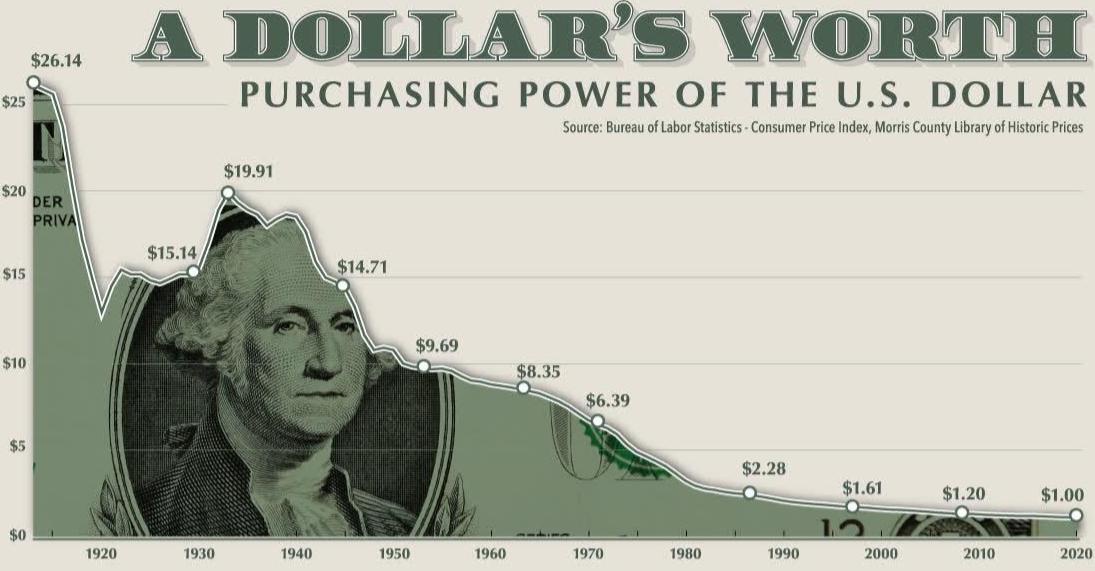

The Bretton Woods system, once a bedrock of global financial stability, has been eroding for decades. The initial peg of the U.S. dollar to gold and the establishment of the International Monetary Fund (IMF) and the World Bank provided a robust framework for economic growth and stability. However, the abandonment of the gold standard in 1971 marked the beginning of the end for this system. Since then, the dollar has been fiat currency, subject to the whims of monetary policy and geopolitical turmoil.

Today, the U.S. and global economies are facing severe challenges: unsustainable debt levels, inflationary pressures, and a rapidly changing geopolitical landscape. The U.S. dollar, once the unchallenged global reserve currency, is losing its hegemony as countries seek alternatives to reduce their dependency on it. These factors contribute to a looming economic crisis that threatens to devalue the dollar significantly.

The Great Taking: A Real Threat

“The Great Taking” is a term used to describe the potential government actions to confiscate or severely devalue personal wealth in times of economic distress. This can manifest in various forms, such as severe inflation, punitive taxation, or direct asset seizures. Historical precedents, like the 1933 Executive Order 6102, which required citizens to surrender gold holdings to the government, highlight the real possibility of such measures being implemented again.

In the event of a major financial collapse, governments may take drastic actions to stabilize the economy, often at the expense of individual wealth. This makes it imperative for citizens to convert their vulnerable U.S. dollars into assets that are less susceptible to government interference and inflationary devaluation.

Assets of Lasting Value

To mitigate the risks associated with the collapse of the Bretton Woods system and the potential for “The Great Taking,” it is wise to invest in assets that have intrinsic value, offer security, and ensure self-sufficiency. Here are the recommended assets:

-

Farmland: Farmland provides a tangible, productive asset that can generate food and income. It is a hedge against inflation and a crucial resource in times of economic instability.

-

Food: Stockpiling non-perishable food ensures that you and your family can sustain yourselves during supply chain disruptions or economic crises.

-

Ammunition and Firearms: These not only provide personal security in uncertain times but can also be valuable barter items if traditional currency systems fail.

-

Precious Metals: Gold, silver, and other precious metals have historically been safe havens during economic turmoil. They retain intrinsic value and are universally recognized as a medium of exchange.

-

Privacy Cryptocurrencies (Monero): Unlike Bitcoin, which offers some degree of transparency, Monero provides enhanced privacy and security. It is less susceptible to government tracking and seizure, making it a reliable digital asset in times of financial uncertainty.

Conclusion: Take Action Now

The signs of an imminent collapse of the Bretton Woods system are clear, and the consequences for those unprepared could be dire. By converting U.S. dollars into tangible assets such as farmland, food, ammunition, firearms, precious metals, and privacy-focused cryptocurrencies like Monero, you can protect your wealth and ensure your security in uncertain times. Waiting for the crisis to fully unfold could leave you vulnerable to the adverse effects of inflation, asset seizures, and economic instability. Act now to safeguard your future and navigate the coming financial storm with confidence.

The Great Taking is actually a term coined by Robert David Webb - A must read

Full book & Docu available free @ https://thegreattaking.com/

these are great articles thanks

Durable tools of all types that you can use or sell are good value in an uncertain future. Useful skills and community are important as well. Lynette Zang talks about all this.